We all always have, knowingly or unknowingly, discussed amongst ourselves various types of markets. We often use these terms very loosely. There are three forms of market structure.

- Monopoly – This can be defined in simple words as the absence of competition. A single company or a group totally or nearly owns the market for a particular type of product or service.

- Perfect Competition – In perfect competition, there is a presence of various firms. No restrictions on the entry or exit of firms. The product is homogeneous, and if one dominating company changes its price structure then other firms have to change their prices to remain in competition.

- Oligopoly – An oligopoly is a type of market structure in which there is a very small number of firms that have maximum market share. Every firm is well aware of the actions of other firms and decisions are made according to that.

As the oil and gas industry is considered a perfect example of an oligopoly type of market, we will mainly focus on the oligopolistic nature of oil.

Prelude

An oligopoly is a type of industry that is dominated by a few firms which shows highly relative and coordinated behavior. Some examples of an oligopoly include the telecommunication industry – in some countries such as the US and Canada where a small number of companies control the majority of the market, and the oil industry- where prices of crude oil largely depend upon geopolitics and the relationship between major producing nations.

Characteristics of oligopoly include:-

- Dominating firms function in accordance with each other to maintain output and pricing which results in their healthy balance sheets.

- Significant obstacles to entry into the market due to high initial costs or limited resources. For instance, it is not easy to set up an operator firm to extract oil and gas.

- The technology involved in production is stable. On the other hand, rapid technology innovation encourages new entrants and price competition as firms with technological and cost advantages will try to drive rivals out of business by lowering prices or by disrupting the supply-demand chain. (One can easily relate this with the recent downturn in the oil industry.)

A cartel is a group or an organization through which members conjointly make decisions about prices and production. This also results in the formation of a center spot from where the whole industry can be controlled or maintained provided that there are no other powerful firms or groups present. One of the well-known cartels is OPEC (the Organization of Petroleum Exporting Countries), whose member countries manipulate production to maintain oil prices.

W. A. Leeman in his book The Price of Middle East Oil: An Essay in Political Economy (1962) perfectly penned the nature of the oil industry which holds even today despite of presence of a large number of firms. Oligopolists (major firms in oligopoly) hesitate to lower the oil prices in the fright of a decrease in profit margins, and they are also hesitant to increase the oil prices in the fear that rivals will not follow and in turn loss of market share. Therefore they rely over the long run to maintain oil prices and earn handsome profit margins. Another description of the oil industry to be an oligopoly is the fact presence of a large number of consumers compared to a small number of sellers.

Oligopoly in the Context of the Petroleum Industry

To understand the oligopolistic nature of the industry, we will first prove how the petroleum industry is an oligopoly.

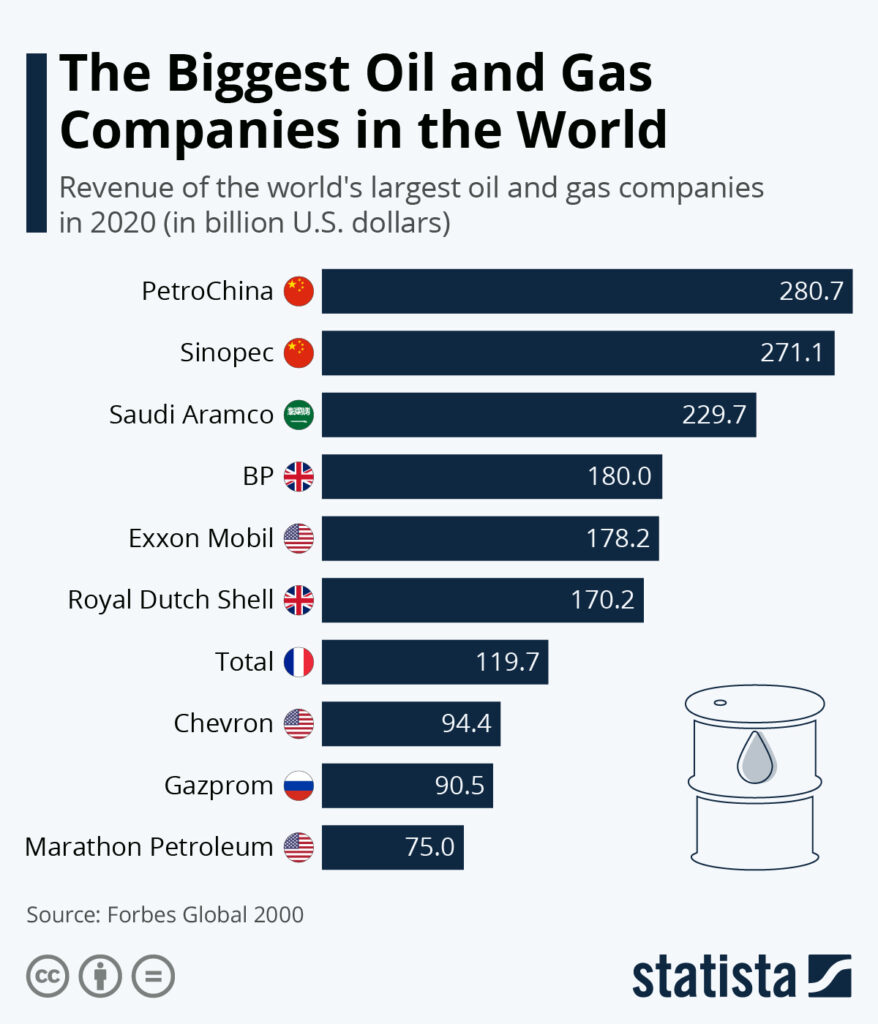

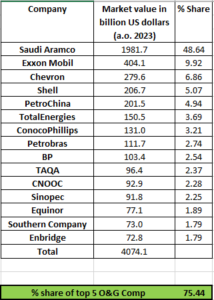

From the above statistical depiction of the ranking of major oil companies in the US according to their market value, one can easily point out that very few companies have control over the market. To understand it in a better way the calculations are shown in the adjacent table. The data in this table is extracted from the above graph. This shows that the top 5 companies in the country control over 80% of the total market.

From the above statistical depiction of the ranking of major oil companies in the US according to their market value, one can easily point out that very few companies have control over the market. To understand it in a better way the calculations are shown in the adjacent table. The data in this table is extracted from the above graph. This shows that the top 5 companies in the country control over 80% of the total market.

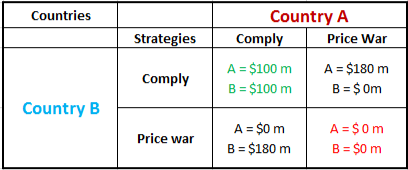

Let us take an example of the current situation in the oil and gas industry. We have two countries viz. A and B produce a good percentage share of total world oil and gas production. Country A recently developed a new technology by which they can produce at a mammoth rate from unconventional resources and that too at relatively lower prices, on the other hand, country B does not have such technology but still is a leader in production. These two countries, in terms of competitive behavior and market share, have the following options:

- They can compete by trying to challenge the other’s price, seizing the market and hoping to drive the competitor out of business, or

- They can cooperate on strategies, each maintaining their market share

Here we are making use of a payoff matrix to describe the basic competitive choices that they have at their disposal.

Analysis

From the above matrix we can see that at any given period they face two choices: either make an agreement and abide by it to avoid the price war, instead enjoy market share, or initiate a brutal price war to increase market share, which may or may not be successful.

- Assume that both countries are keen to avoid a price war and mutually agree to abide by the agreement and avoid price cutting. In such case, we end up in the upper left cell of the matrix and each country earns profits of $100 million.

- Alternatively, suppose Country A decided not to follow the agreement and wants to enjoy handsome profits by snatching the market share. In such case, we end up in an upper right cell of the payoff matrix resulting in a tremendous increase in profits of country A. Country B, due to this decision, experiences a loss of market.

- Or country B betrays country A and takes part of the market share with a strategically planned new price structure. This will result in a loss of profits for Country A.

- Finally, both companies enter into the competition by cutting prices. This triggers the brutal price war and also affects other dependent industries. This will eliminate profits. In other words, when each country acts exclusively in its interest, a price war is unavoidable.